If you purchased a Port St. Lucie home, refinanced, or had a title change in 2024, you might be shocked at what you find in your mailbox from the county. 🤬

Did you get your Real Estate TRIM notice in the mail? The St. Lucie County property appraiser sends it via mail every August to the homeowner’s address on file.

If you have not received your TRIM notice by the end of August and you own a home or land in St. Lucie County, please contact the county property appraiser to get that fixed. You can also see your TRIM notice online at the St. Lucie County Property Appraiser Website.

What is the Real Estate TRIM Notice?

TRIM stands for “Truth-in-Millage” (TRIM) act. It informs you which governmental entity is responsible for the taxes levied and the amount of tax liability owed to each one.

The 1980 Florida Legislature’s Truth in Millage Act was designed to inform taxpayers which governmental agencies are responsible for the property taxes levied on your home or land.

The Notice of Proposed Tax forms, also known as Truth in Millage (TRIM) notices, are prepared and mailed each year by the Property Appraiser on behalf of the taxing authorities pursuant to Florida law.

This is not your tax bill, It is intended to notify you of possible changes that may appear on the November tax bill.

What are the Property Tax Calculations Based On?

There are two main pieces to the calculation on your Real Estate TRIM Notice

- The Millage rate from the taxing authority. Changes to this rate go through a defined public legislative process.

- The Assessed Value of Your Property.

The assessed value equals the market (just) value less any assessment reductions, agricultural classifications, limitations, or caps that have been applied. Homestead and non-homestead properties may have an assessed value that is lower than market value due to the Save Our Homes cap, or the 10 percent Assessment Growth Limitation cap.

Market (just) value is defined as the most probable sale price for a property in a competitive, open market involving a willing buyer and seller on January 1. The market value is unencumbered and may increase or decrease as the market dictates.

The whole process is governed by Florida Law including s.193.011, F.S.

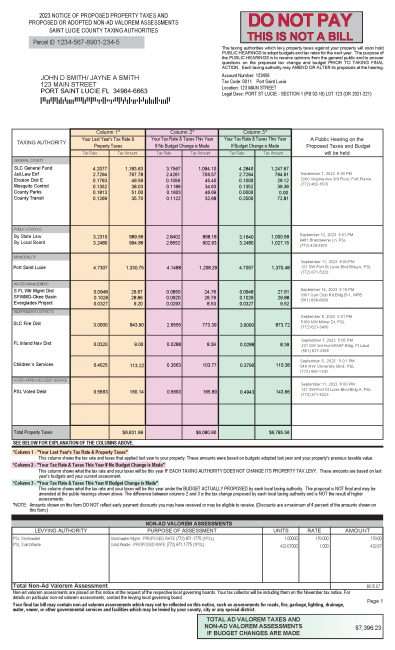

What’s on the Real Estate TRIM Notice?

The St. Lucie County Property Appraiser explains the first page well:

Column 1 highlighted in orange, shows values as they were applied last year, based on the previous year’s budgets and the previous taxable value of your property. This is for your comparison purposes only, as the tax roll for last year has been certified and closed.

Column 2 highlighted in pink, shows what your taxes could be this year if each taxing authority chooses to generate the same amount of property tax revenue that was approved for the prior year. These rates and resulting taxes are based on last year’s budgets and your current property assessment.

Column 3 highlighted in green, shows the proposed rate and resultant taxes if each taxing authority adopts their proposed rate. These amounts are not set in stone as the exact budget may change after public hearings. Dates, times, and contact numbers are advertised in the next column.

In the public hearings column, each taxing authority provides a scheduled budget hearing date, time, and contact information. If you have any questions, or concerns, or wish to discuss the amount or use of taxes, we strongly encourage you to attend the hearings or call your local taxing authority.

Visit the St Lucie County Property Appraisers TRIM notice page for more explanation of page 1 and 2.

Can the Property Appraiser lower taxes or change tax rates?

No. The Property Appraiser cannot lower your taxes or millage rates. Although the Property Appraiser’s office is responsible for mailing the TRIM notice, the market, assessed, and taxable values are the only issues this office has the authority to address.

However, if a correction or change to your property is made, the resulting taxation level may be affected.

If you purchased your Treasure Coast home during the past year, your assessed value for the next year may be substantially higher than last year due to the removal of the previous owner’s cap. If you built a home, you’ll see that the just market value of your prior tax bill was based on land value only, and your new tax bill reflects a home with a new assessment.

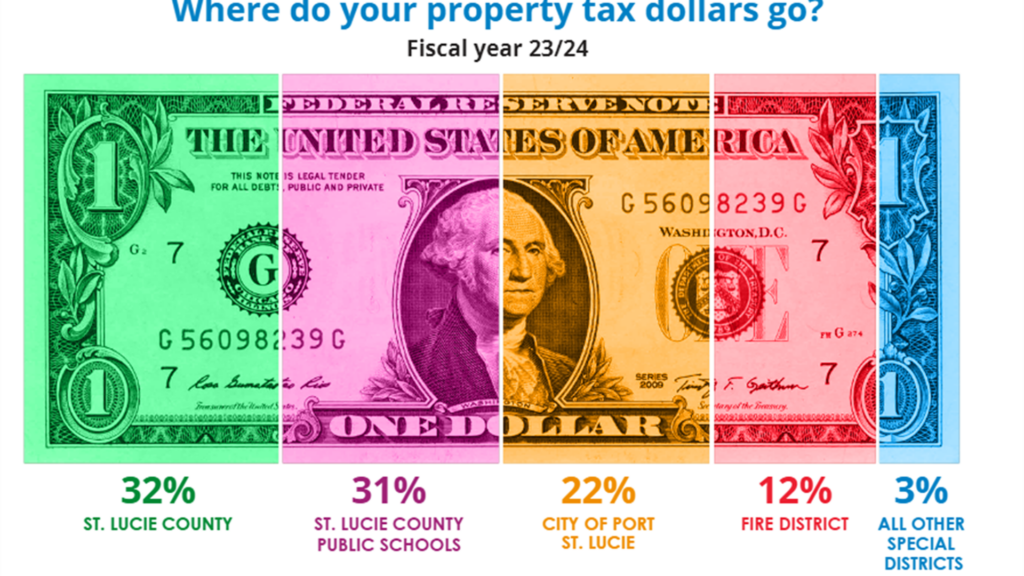

Tax Lines from the CITY of Port St. Lucie

If your property is in the CITY of Port St. Lucie (vs. the County), there are only two line items from the CITY (2024):

- PSL Voter-Approved Debt

- Port St Lucie (in the Municipality Block)

Those are the only two millage lines that are from the CITY.

Over the past seven years, the City’s millage has decreased from 6.6289 in fiscal year 2015/16 to 5.3000 for fiscal year 2022/23. Tax year 2023/2024 was 5.2000.

If the budget is approved for the Trim notice, the City millage rate will have dropped further to 5.028. This will be the ninth decrease for the City since 2015/16

.Other non-City taxing authorities are responsible for all the other line items on your TRIM Notice.

Read More: City of Port St Lucie Tax Department

Learn More about Your St. Lucie County Real Estate TRIM Notice

The St. Lucie County Property Appraiser has developed a section on their website about the TRIM Notice. In their FAQ Section, you’ll find answers to these common questions:

- Why are my taxes so much higher this year?

- Why are my neighbor’s taxes lower than mine?

- How do I know if I have a Save Our Homes Cap?

- Where is my Portability listed on my TRIM Notice?

- What is the difference between Ad Valorem Taxes and Non-ad Valorem Assessments?

- What is the Appraisal Process?

- How do I view my TRIM Notice online?

- What is the tax rate?

- What are the phases of the property taxation process?

Read More: St. Lucie County Property Appraisers TRIM NOTICE